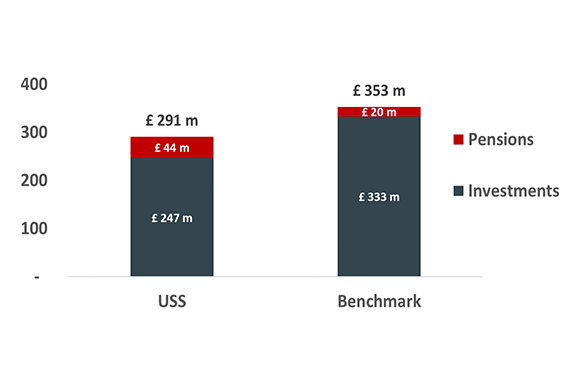

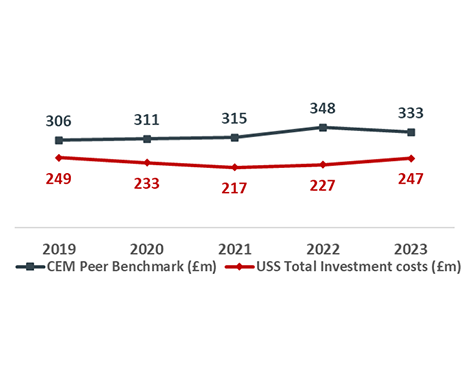

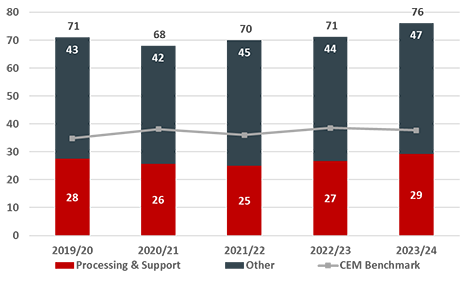

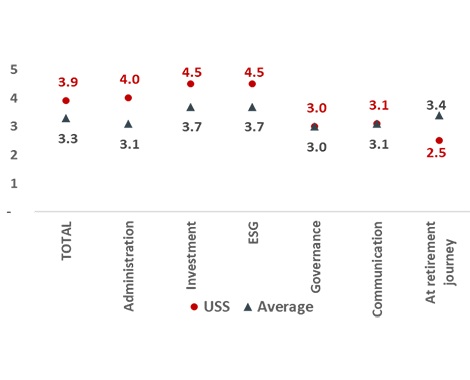

We are consistently less expensive in total than our peer group*

CEM Benchmarking (a leading independent benchmarking organisation) compares us to a peer group. In the latest available comparison (calendar year 2023), we were significantly less expensive in total than our peer group (£62m or 8bps). The substantial advantage in investment management more than offsets the higher pension administration/scheme governance cost.

*Costs are presented on the CEM basis. Scheme costs reported in the Financial review and Value for Money section of the 31 March 2025 annual Report and Accounts are £286m.