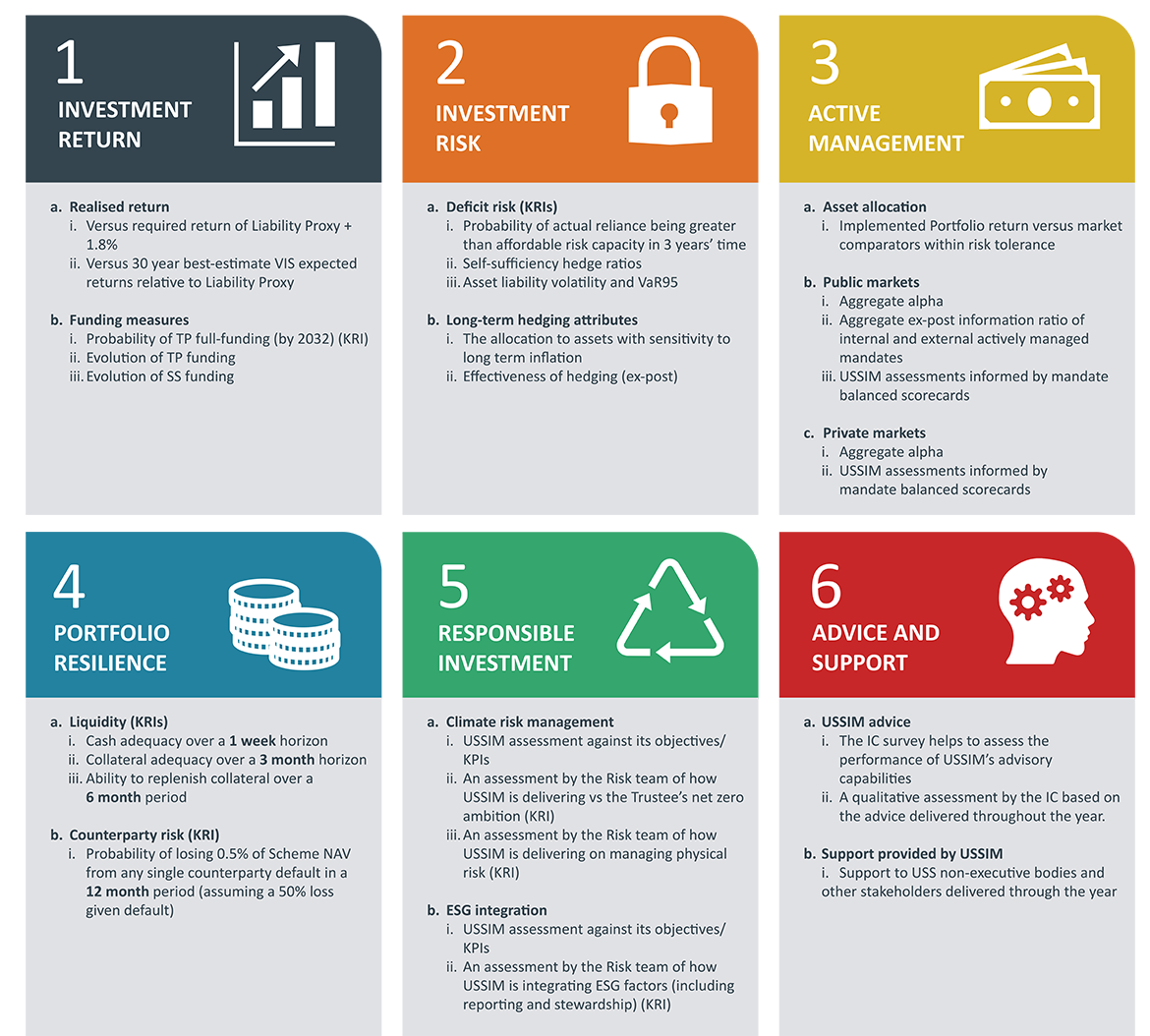

1. Investment return

a. Realised return:

i. Versus required return of Liability Proxy +1.8% ii. Versus 30 year best-estimate VIS expected returns relative to Liability Proxyb. Funding measures:

i. Probability of TP full-funding (by 2032) (KRI)

ii. Evolution of TP funding

iii. Evolution of SS funding

2. Investment risk

a. Deficit risk:

i. Probability of actual reliance being greater than affordable risk capacity in 3 years’ time

ii. Self-sufficiency hedge ratios

iii. Asset liability volatility and VaR95

b. Other liability hedging attributes:

i. The allocation to assets with sensitivity to long-term inflation Effectiveness of hedging (ex-post)

3. Active management

a. Asset allocation:

i. Implemented Portfolio return versus market comparators within risk tolerance

b. Public markets:

i. Aggregate alpha

ii. Aggregate ex-post information ratio of internal and external actively managed mandates

iii. USSIM assessments informed by mandate balanced scorecards

c. Private markets:

i. Aggregate alpha

ii. USSIM assessments informed by mandate balanced scorecards

4. Portfolio Resilience

a. Liquidity (KRIs):

i. Cash adequacy over a 1 week horizon

ii. Collateral adequacy over a 3 month horizon

iii. Ability to replenish collateral over a 6 month period

b. Counterparty risk (KRI):

i. Probability of losing 0.5% of Scheme NAV from any single counterparty default in a 12 month period (assuming a 50% loss given default)

5. Responsibility investment

a. Climate risk management:

i. USSIM assessment against its objectives/KPIs

ii. An assessment by the Risk team of how USSIM is delivering vs the Trustee’s net zero ambition (KRI)

iii. An assessment by the Risk team of how USSIM is delivering on managing physical risk (KRI)

b. ESG integration:

i. USSIM assessment against its objectives/KPIs

ii. An assessment by the Risk team of how USSIM is integrating ESG factors (including reporting and stewardship) (KRI)

6. Advice and support

a. USSIM advice:

i. The IC survey helps to assess the performance of USSIM’s advisory capabilities

ii. A qualitative assessment by the IC based on the advice delivered throughout the year

b. Support provided by USSIM:

i. Support to USS non-executive bodies and other stakeholders delivered through the year