£5.3bn invested

These are investments in core UK property and long-term inflation-linked leases, like industrial estates, retail parks, and offices. For example, Grand Arcade shopping centre in Cambridge.

These are investments in securities that aren’t traded publicly, and include asset classes like infrastructure, private growth, private credit, private equity, and property. Investing in private markets is attractive for pensions schemes as historically they have generated attractive returns (after taking risk into account), and often benefit from long-term stewardship.

Private markets provide access to a source of return that isn’t always available in public markets. They can often provide long-term inflation linked returns that align to our long-term pension promises and give us the opportunity to invest in growth markets that support decarbonisation.

We invest around the world in high-quality private assets and companies with strong management teams across a variety of sectors. While we have a global footprint, we’re major investors in the UK.

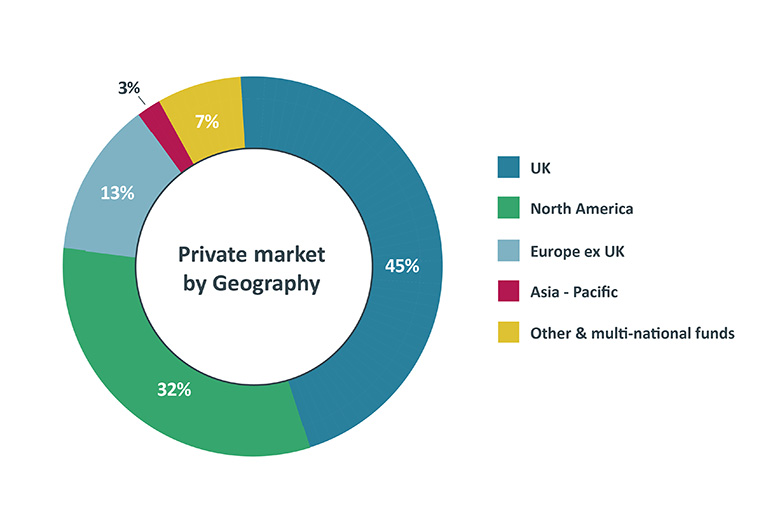

We have nearly £26bn invested in private markets. 45% of this (approximately £12bn) is invested right here in the UK. Examples of our UK investments include:

As well as our UK portfolio, we invest in businesses across Europe, Australia and the Americas covering solar, toll roads, reusable pallet logistics, gas networks, woodland, and a port.

We have around £2bn invested in renewable energy and clean technology. This includes assets such as:

Alongside this, we consider alternative sources of energy at many of our other investments. For example, hydrogen gas as an alternative to natural gas with Redexis.

Since February 2020, both the Retirement Income Builder (the defined benefit part of USS) and the Investment Builder (the defined contribution part) are invested in these private assets. We were one of the first pension schemes to provide members with access to private market assets with no increase in cost to members or employers.

Visit Private Markets Group for more on the team that manages our private market investments. You can also visit our case studies page for more detail on some of the assets we’ve talked about here.

We've been invested in Moto since 2015 given the predictable returns it can generate for our members as well as being well positioned to support the electrification of UK motorways: