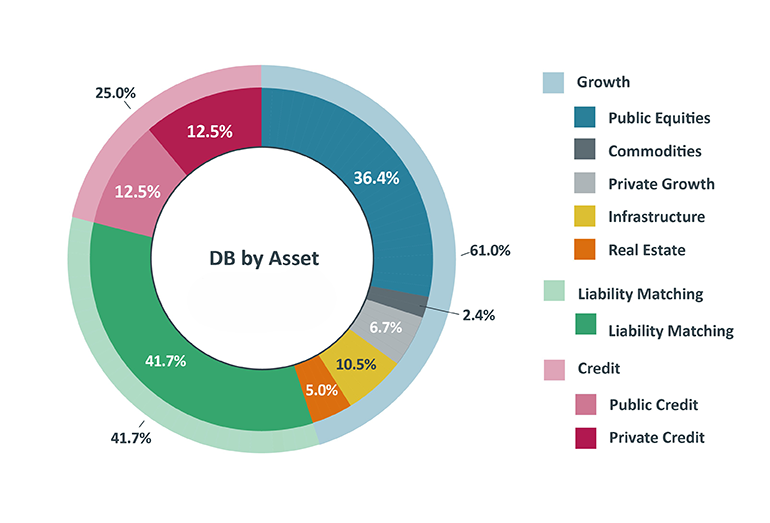

Growth: 61.0%

- Commodities: 2.4%

- Infrastructure: 10.5%

- Private growth: 6.7%

- Public equities: 36.4%

- Real estate: 5.0%

Liability matching: 41.7%

Credit: 25.0%

- Private credit: 12.5%

- Public credit: 12.5%

Net Leverage: -27.7%

Total: 100%

We invest contributions with long term goals in mind so that we can pay pensions long into the future. We have £76.8bn in assets across the Retirement Income Builder – the defined benefit (DB) part that provides a guaranteed income in retirement – and the Investment Builder – the defined contribution (DC) part that allows you to save more towards your future in your own savings pot.

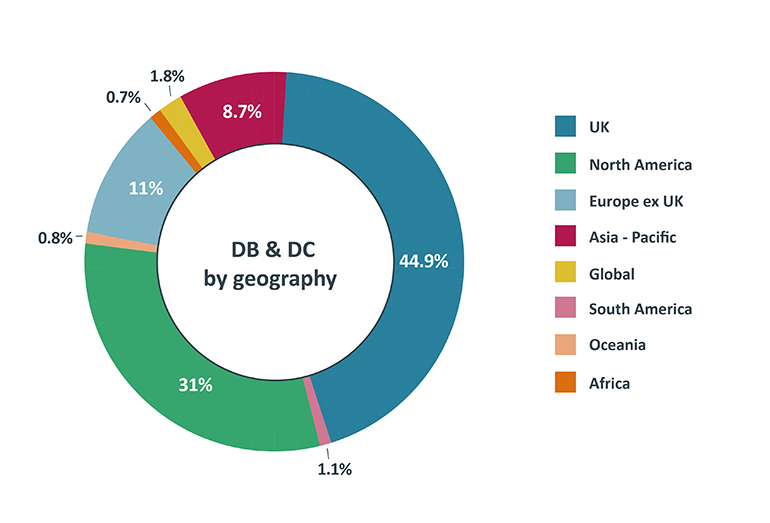

We invest in both private and public markets in a whole range of different assets across the world. By actively investing in such a diverse way, we have an investment portfolio that aims to reduce risk and be more resilient both to short-term market movements and long-term trends. It also provides more opportunities to generate better returns to help towards your financial future.

Closer to home, around 45% of our investments are right here in the UK.

Both the Retirement Income Builder and Investment Builder are invested in much the same way. One difference is that our DC investments are mostly managed by external investment managers, whereas our DB investments are mostly managed internally by USS Investment Management Limited, or USSIM, our in-house investment manager. They’re responsible for managing around 70% of our DB investments themselves.

Our global Retirement Income Builder (DB) investments are split across three main categories – growth, credit and liability matching:

Our Investment Builder assets in the USS Growth Fund are also split across three main categories – growth, credit, and UK government bonds. As of 31 March 2025, most DC assets were invested in the USS Growth Fund (£2.1bn):

For more detail, and a breakdown of where we invest for the rest of our Investment Builder funds, see our Quarterly Investment Reports.

Have a read through our handy investment glossary to learn more about the terms we use.